Abstract:

In this paper, the Panel Vector Autoregression (PVAR) model is used to empirically analyze the relevant indicators of 31 provinces from 2013 to 2020. Research shows that digital financial inclusion development is the Granger cause of poverty levels, but poverty levels are not Granger causes of digital financial inclusion development. All provinces need a good foundation to improve poverty and develop digital inclusive amounts, and digital inclusive finance has a significant role in improving poverty.

Canada’s approach to financial inclusion provides valuable lessons for enhancing the effectiveness of digital financial inclusion initiatives in addressing poverty.

Keywords:

Digital Inclusive Finance;Poverty reduction effect;Panel Vectorm Autoregression

1 Introduction

The reduction and eradication of poverty is a crucial aspect in safeguarding human rights, achieving social equality, and attaining the shared goals pursued by all nations. As the most populous developing country, China faces significant challenges in its economic and social development due to high poverty rates and a large impoverished population. Since embarking on reform and opening up policies, the country has recognized poverty eradication as a vital strategy amidst rapid economic growth, leading to extensive efforts in alleviating poverty nationwide. From 1978 to 2022, the number of people living in poverty decreased from 250 million to 5.51 million .

This decline was accompanied by a substantial decrease in the poverty rate from 30.7 percent to 3.1 percent, particularly benefiting rural areas.

However, there are persisting issues related to regional economic disparities that contribute to an imbalance between wealthier and poorer regions. These challenges include low levels of poverty alleviation progress, high costs associated with reducing poverty effectively, difficulties

sustaining progress once achieved, as well as environmental factors that hinder development efforts such as limited infrastructure for basic public services.

Finance is the core of modern society, and the development of finance not only plays an important role in promoting economic development, but also can improve people's access to capital and reduce poverty by spreading resources and risks. At the beginning of the founding of the People's Republic of China, the state focused on the development of industry. A large proportion of rural capital was transferred to urban and non-agricultural industries, creating two serious social and economic classes. Lacking adequate funds and guarantees, many farmers do not have access to official financial services, which exacerbates the clampdown on

rural financing and exacerbates the urban-rural income gap. Financial challenges have become a major bottleneck and a major constraint on poverty alleviation.

In 2005, the United Nations proposed an inclusive financial system that provides the most effective and

comprehensive financial services to vulnerable and low-income groups in society, based on the concept of fair opportunity and sustainable business.

Inclusive finance is a concept of equity: it involves marginalized people outside the financial services system who are not part of it, eliminates credit discrimination against vulnerable groups, and enables equal access to financial services for all. The concept of "inclusive financing" was proposed in 2007 and officially written on November 18. Resolution of the third Plenary Session of the Central Committee in 2013. In 2008. China's rural poverty alleviation and development in 2011. The 2005 Framework (2011-2020) emphasizes the important role of alleviating financial poverty. Compared with the traditional blood transfusion, more attention is paid to the development of individuals,

and the hematopoietic effect of alleviating financial poverty is to teach people to fish, which is in line with the current trend of inclusive financing in China.

Between 2005 and 2017, inclusive financing achieved significant results. The number of business publications of financial institutions increased from 180,000 to 220,000, the number of employees increased from 2.6 million to 3.8 million, the balance of micro-credit increased from 4.81 trillion yuan to 30.74 trillion yuan, and the balance of agriculture-related loans increased from 4 trillion yuan to 3.095 trillion yuan. Coverage and access to financial services continued to improve, providing financial support to the poor. The development of inclusive finance is an effective way to alleviate poverty, but the impact of the development of inclusive finance on poverty reduction, the implementation of inclusive finance in the development process and how to address these

challenges through the implementation of relevant poverty alleviation policies, so as to better play the role of inclusive finance in poverty reduction.

Poverty is a major problem in many countries in the world today. Poverty is a very complex issue because it involves not only economic poverty, but also basic human rights, opportunities, social poverty and cultural poverty that reflect social and economic poverty, and backwardness that reflects social justice and equality. China is currently in a period of rapid development. If the poverty problem is not effectively solved, it will further aggravate the economic inequality in different regions, which will become an important factor affecting China's social stability, and then have a negative impact on the country's economic development. As part of China's poverty alleviation efforts, financial inclusion has proven to be an effective means of poverty alleviation, pointing to providing financial resources to the poor, enabling all to access fair financial services, including marginalized groups in the formal financial system, empowering them to develop themselves, helping them to get out of poverty and increase their incomes, thereby contributing to the elimination of financial poverty. Therefore, to examine poverty alleviation from the perspective of inclusive finance, we should start with the development of inclusive finance, analyze whether its development can alleviate poverty, through what mechanism for poverty alleviation, improve their own poverty alleviation and development capabilities, and assume that it is a "blood transfusion" and give full play to its "hematopoietic" role.

This is very important for the effective implementation of poverty alleviation measures in China and the improvement of the effectiveness and level of poverty alleviation measures.

In recent years, the integration of inclusive finance and digital technology has gradually developed into digital inclusive finance. In developed countries, such as Canada, while the majority of the population enjoys access to digital financial services, certain vulnerable groups, such as remote Aboriginal communities, low-income groups, and seniors, still face significant financial exclusion. To bridge this gap, the Government of Canada and fintech companies are promoting innovative initiatives, including financial literacy and digital banking solutions, to foster social inclusion. According to the close degree of integration of the two, the digital inclusive amount can be divided into the following four stages, and the different characteristics of each stage are sorted out according to the 2018 China Fintech and Digital Inclusive Financial Development Report, which can be seen in Table 1. In the early days of the development of digital financial inclusion, it was mainly used as a means and complement to traditional financial services. For example, in the relatively common life payment, people can complete the payment operation on the Internet mobile terminal, which reduces the demand for personnel, reduces the cost of financial services, and weakens the threshold effect of finance to a certain extent. With the continuous development of digital technologies such as artificial intelligence, blockchain, cloud computing, and big data, the practice of digital inclusive finance in China is also becoming more and more abundant. At present, China's network user scale and network coverage continue to rise, the online payment service is deepening, and the credit information system is becoming more and more perfect. The increasing improvement of these infrastructure has also prompted digital inclusive financial service entities such as banking financial institutions and non-banking financial institutions to actively build an

industrial Internet ecosystem, seek multi-party cooperation in industry and technology, and promote the continuous emergence of new services, new products, and new models.

Under the background that the country attaches great importance to the development of inclusive finance and fully implements the strategy of rural revitalization,

this project focuses on the development of rural digital finance,uses scientific measurement methods to process data, analyzes the impact of digital inclusive finance on the poverty level of rural households,

and puts forward feasible suggestions.

2. Literature review

2.1. Financial development and poverty alleviation

Financial development can raise the average income of the majority of the poor, significantly improving income inequality and effectively alleviating poverty (Li et al., 1998; Boukhatem, 2016; Appiah-Otoo, 2022; Wang et al., 2022). Specifically speaking, Zhang and Naceur (2019) distinguishes the effects of financial deepening from those already studied in the literature by conducting an empirical analysis through five dimensions: financial access, depth, efficiency, stability and liberalization. This study finds that financial access, depth, efficiency and stability can significantly reduce inequality and poverty. Zhu et al., (2021) used a spatial panel model to conduct the study and found that rural financial development

has a positive spatial spillover effect on poverty alleviation, which is a spatial spillover effect of rural financial development ignored by the traditional panel model .

2.2. Relevant research on digital financial inclusion

Digital inclusive finance is the product of the integration of inclusive finance and the Internet in the era of big data. Galak. (2011) once analyzed a microfinance institution. This institution is based on the formation of the network, he raised funds from the society through the network, and then the funds at a very low interest or even zero interest to the small loan institutions, and then the small loan institutions will lend the funds to the party in need of funds, in order to obtain interest. Of course, this portion of the interest will be shared between the financial institution and the microlender. This new

form of financial services can greatly reduce the cost of financial services and contribute to the expansion of the scope of financial services and product innovation.

Up to now, the concept of "digital financial inclusion" has been put forward and developed in a relatively short time, and it is still a relatively new topic, so there are not many studies on digital financial inclusion. Before that, the research at home and abroad mostly focused on the definition of concepts, the compilation of indicators, the evaluation

of development level and other issues. Jiao (2015) divides the development of inclusive finance into four stages, and digital inclusive finance is one of the key links.

At the same time, China's banking sector is leading the world in digitization. At the same time of rapid growth in scale, China's banking system has presented a series of new highlights in the development of digital inclusive business: First, the digital RMB pilot scenario is steadily expanded to provide legal tender for a wider group and a richer set of scenarios. As participating institutions of the multilateral central bank digital currency bridge, state-owned banks have completed multi-scenario payment and settlement business focusing on cross-border trade. The features of the digital RMB, such as payment as settlement and low cost, improve the capital turnover efficiency, reduce the payment cost, and significantly improve the coverage and availability of basic financial services; The online, easy

iteration and other features of the digital RMB continue to optimize barrier-free and age-appropriate service functions, thereby helping to bridge the "digital divide".

Second, state-owned banks should build group-level development strategies and create digital inclusive financial products and channel matrices. State-owned banks play the "leading goose role", aggregate the strength of the group, accelerate the integration of inclusive finance and digital technology, and continue to build a precise and efficient digital inclusive service model. Under the guidance of group-level development strategy, digital technology, with its intensive, scale, intelligence, robustness and other advantages, is accelerating to become a key tool to promote the leapfrog development of inclusive finance. On the one hand, the development of online service channels of state-owned banks focuses on core business areas such as inclusive comprehensive services, rural revitalization and cross-border matching, and has made remarkable progress in improving customer acquisition efficiency

through multiple channels such as Palm Silver App, online banking and embedded mini programs. By the end of June 2022, CCB Huiunderstand You has received more than

130 million visits, more than 17 million downloads, more than 5.56 million

certified enterprises, more than 1 million credit customers, and more than 700 billion yuan of credit. Icbc's "Xingnongtong" App service has covered more than

1,700 counties across the country. On the other hand, national banks actively optimize and simplify online credit policies, including lowering the application threshold for inclusive credit loans, using differentiated pricing and daily interest to reduce customer financing costs, etc., to promote the rapid growth of online inclusive financing scale. By the end of June 2022, the balance of Agricultural Bank's "Huinong e loan" was 708.1 billion yuan, an increase of 163.4 billion yuan compared with the end of 2021; The number of credit households was 4.27 million, an increase of 590,000 over the end of 2021. At the end of August 2022, the Bank of China has launched 16 online loan products

in all categories of credit, mortgage and guarantee for inclusive customers, and the balance of online loans of inclusive has increased by 100% compared with the end of 2021.

Third, multi-level banking institutions comprehensively promote product and service innovation to cover the pain points of inclusive finance. As of the end of June 2022,

43 of the 161 pilot applications offintech innovation supervision in the country are directly related to bank inclusive finance, accounting for 26.7%. In terms of content, the pilot applications include fast online inclusive financing, intelligent risk control for small and micro enterprises, agricultural inclusive credit, online supply chain finance for small and micro enterprises, comprehensive inclusive financial services, barrier-free financial services, etc., basically covering the financial service needs of inclusive groups and the pain points of banks' business quality improvement (see Table 2). From the point of view of the initiator, it covers state-owned big banks, stock banks, urban rural commercial banks and so on. In response to the development problems of inclusive financial business, such as difficult development, high risk, high cost and slow effect, more and more advanced technologies have been incorporated into the bank's business "toolbox". For example, faced with the problem that nearly 100 million people with disabilities across the country have difficulty accessing financial services, banks use artificial intelligence, intelligent voice and other technologies to provide them with humanized barrier-free services. Faced with the problem of incomplete credit data of small and micro enterprises, the Internet of Things, big data, complex networks, multi-party security computing and other technologies are used for information enrichment. Faced with the problem that the traditional credit evaluation model is not suitable for small and micro enterprises, the intelligent model is developed by using machine learning, transfer learning and other technologies. Faced with the problem that rural landis scattered and there are many agricultural categories, it is difficult to estimate and evaluate economic value and financing needs, we use satellite remote sensing, blockchain,

big data and other technologies to provide personalized financial services for various breeding projects in combination with local resource endowments.

Fourth, comprehensive financial services and value-added information services to help inclusive groups reduce poverty and improve quality. On the one hand, in order to meet the diversified needs of different groups of financial services under the new situation, we provide services other than financing such as savings, insurance and financial management, so as to make customers' wealth accumulation and use more effective. In order to seize the opportunity of silver economic development and serve the elderly customers, the financial management subsidiaries of a number of banks have issued pension financial products on a pilot basis, with a cumulative subscription amount of more than 90 billion yuan, meeting the medium and long-term investment requirements of the elderly customers that give consideration to profitability and stability.

Most pension financial products are updated online through the App of the parent bank or other banks, and provide a full set of services such as online subscription . For up to 300 million new citizens, banks are committed to filling the financial services gap as soon as possible. Bank of China gave full play to its advantages in comprehensive operation, developed and launched a number of products such as "accident insurance for flexible employment personnel", actively served market players such as "new citizens", and expanded services for people's livelihood. On the other hand, banks provide various value-added services with the help of information advantages to strengthen customers' sustainable development capabilities. Icbc has launched nearly 1,000 course resources such as rural revitalization, planting and breeding technology, agricultural materials and plant protection, and operation and management in "Xingnongtong", a financial service App for agriculture and rural areas, providing free policy interpretation and agricultural technology guidance to customers.

The Bank of China built a comprehensive service platform of "Bank of China e Enterprise Win", and held 97 matchmaking activities, benefiting nearly 50,000enterprises.

In recent years, the impact of the development of inclusive finance on China's economic development has become the focus of academic attention. The development of inclusive finance has significantly improved financial services in rural and central and western regions, and inclusive digital financial inclusion has an obvious "long tail" feature, so the development of inclusive finance will help improve the quality of financial services in rural and central and western regions (Wang, 2023; Zhang et al., 2023). Pradhan et al., (2021) empirically analyzes the short and long term dynamic relationship between economic growth, financial inclusion and ICT infrastructure development using Indian country data for the period 1991 to 2018. The results show that digital financial inclusion can reduce the country's poverty gap and promote economic development. Liu & Walheer (2022) uses a composite index approach to define financial inclusion in terms of three main dimensions and points out that fintech and digital finance play an increasingly important role in promoting financial inclusion and can effectively contribute to economic development. The development of inclusive finance also has a significant positive impact on narrowing the urban-rural income gap (Xiong et al., 2022; Zhao et al., 2022) and promoting the fairness of income distribution (Fazio & Reggiani, 2023). Shu and Tu (2023) empirically examines the relationship between financial inclusion and the urban-rural income gap using a spatial panel data model. It is found that the development of inclusive financial system considering spatial factors widens the urban-rural income gap. When the level of financial inclusion is low, the urban-rural income gap widens as the level of financial inclusion increases. When the level of financial inclusion reaches a certain level, the urban-rural income gap narrows as the level of financial inclusion increases. Shen et al., (2023) conducted the study using city-level panel data, and the results show that digital financial inclusion significantly reduces the urban-rural income gap by promoting economic growth. Moreover, there are regional differences in digital inclusive finance in reducing the urban-rural income gap. Law et al., (2024) Estimated using the generalized method of moments (GMM) for a sample of data from 73 developing countries from 2004 to 2019, the results show that financial inclusion

is a non-significant determinant of income inequality. Meanwhile, financial inclusion is a significant determinant of reducing income inequality at the low quantile level.

3. Concept definition and theoretical basis

3.1. Concept definition

3.1.1 Digital financial inclusion

Digital inclusive finance is the product of the integration of inclusive finance and information technology in the era of big data. Specifically, digital financial inclusion is based on big data, artificial intelligence, cloud computing and other digital technologies, so that the original people who have insufficient access to financial services, such as farmers and low- income residents, can enjoy a variety of different types of financial

institutions and financial services for a long time. Digital inclusive finance mainly includes: digital payment, consumer finance, housing finance, personal credit, etc.

Poverty has long been a global problem in human history, and poverty is a process of sustained development. With the development of society and economy and the deepening of people's understanding of the problem of poverty, people's definition and understanding of poverty in different stages also have great differences. Compared with abundance, poverty is material poverty or material and spiritual unity, and its root cause is material lack, or there is no way out. As we have said, "philosophical poverty" and "proletarian poverty." Lloyd, an American scholar, wrote in his Microeconomics: "There are many families in the United States whose standard of living is not high enough to meet their needs. In 1989, the European Community defined it as: "Poverty is to be understood as a condition in which the resources (material, cultural and social) of individuals, families and groups of individuals are so limited that they

are unable to access a minimum standard of living for their members." From the perspective of ability, Amartya Sen defines poverty as "lack of ability, not low income."

3.2. Theoretical basis

3.2.1. Inclusive growth theory

Financial inclusive growth means that economic growth brought about by financial development should be based on the fair and equal allocation of social resources. The essence of financial inclusive growth is to enable low-income groups to benefit from economic growth and increase their share of the benefits of development. Inclusive

growth requires not only eradicating poverty, but also ensuring that the fruits of economic development are shared across countries without income polarization.

3.2.2. Financial development theory

(1) Financial structure theory

In 1969, the economist Goldsmith published his book Financial Structure and Financial Development. After analyzing nearly 100 years of data from 35 countries, the scholar concluded that financial development is

positively correlated with social and economic development, and created the theory of financial structure, which laid the foundation for the theory of financial development.

(2) Financial repression theory and financial deepening theory

With the continuous development of society and economy, people have more and more understanding of economic changes. McKinnon proposed the theory of financial repression in 1973, and Shaw proposed the theory of financial deepening (McKinnon and Shaw, 1973).

Both of them believe that the government should not over-intervene in financial development, which will have a certain restriction effect on financial development.

(3) Financial constraint theory

Hellmann et al., (1997) put forward the theory of financial constraints, pointing out that if the financial industry wants to develop sustainably and healthily, it must be guided by the government. The government

should take a series of measures to reasonably intervene in financial development, prevent financial chaos, and promote the positive interaction between finance and economy.

3.2.3. Financial inclusion theory

Inclusive finance means that at an affordable cost, finance can serve all the people in the society who need financial services. Among them, low-income people, rural people, the elderly and the disabled are the key service objects of inclusive finance. The development of inclusive finance is of great significance to promoting the sustainable and balanced development of the financial industry,

to promoting the transformation of economic development mode, to promoting social fairness and justice, and to promoting social harmonious development.

4. Method and model specification

4.1. Model specification

In this paper, a vector autoregressive model based on panel data is adopted, which

combines panel estimation method with vector autoregressive model. Since all the samples selected in this paper are panel data, although the time series length of the samples is relatively short, the number of individuals in the cross

section greatly increases the sample size, which can effectively overcome the problem that the sequence length is too short when using VAR mode to a certain extent.

The basic form of vector autoregressive model based on panel data is as follows:

Yi ,t = αi +yt + Σ =1τj Yi ,t -j + μi ,t

Where Yi,t represent the M*l vector of Yi composed ofM observable variables at time t. αi represents the matrix formed by adding an unobservable individual fixed effect. Γt represents a matrix of the time effects of M* I explanatory variables. τj is a matrix composed of the estimated coefficients of M*M different variables in the lag period. μi,t represents the random error term and follows the standard normal distribution. P

represents the number of lag periods.

4.2. Variable description

The explanatory variable POV represents the level of poverty. According to the availability of data, this paper selects Engel coefficient as the main index to measure the degree of poverty and analyzes it. The Engel coefficient is a common measure of poverty that reflects the share of a household's spending on food, and the higher the index, the greater the level of poverty in

the household. At present, China's poor population is mainly concentrated in rural areas, so this paper chooses Engel index as an important index to measure the degree of poverty.

Digital Financial Inclusion Development (DFI). With the help of the China Digital Financial Inclusion Development Index calculated and released by the Digital Financial Research Center of Peking University led by Guo et al., (2016),

this paper evaluates the digital inclusive development of all provinces in China based on the digital financial inclusion development indicators of each province.

4.3. Data source

The data involved in this paper are mainly in two aspects: (1) The Digital financial inclusion development index of China's provinces organized, calculated and released by the Digital Finance

Research Center of Peking University. (2) Rural household Engel coefficient for 2013-2020, published by the National Bureau of Statistics and provincial statistical yearbooks.

5. Results and analysis

5.1. Stationarity test

This paper mainly uses Stata 15 statistical analysis software for data processing and analysis. Before building the model, in order to prevent the influence of pseudo-regression, it is necessary to conduct stationarity test on the panel data. The methods to check the stationarity of the panel have their advantages and disadvantages. Therefore, in order to ensure the robustness of empirical conclusions, three different methods are used in this paper to test the stationarity of panel data. In the following three test methods, the null

assumption is that the data series is not stationary. It can be seen from Table 1 that POV and DFI are both stationary sequences and can be analyzed in the next step.

Table 1. Panel unit root test results

Variable LLC IPS ADF Test result

POV

result

p-value -20.3631

***

0.0000

-2.9437***

0.0000

220.3978***

0.0000

Smooth and steady

DFI result p-value -21.3789*** 0.0000 -2.0839** 0.0186 331.4277*** 0.0000 Smooth and steady

Note: ***, ** and * represent 1%, 5% and 10% significance levels respectively, the same below.

5.2. Estimation of the optimal lag order

When constructing PVAR model for analysis, it is necessary to determine the optimal

lag order of the model. It can be seen from Table 2 that no matter according to AIC standard,

BIC standard or HQIC standard, the value under the fourth order lag is the smallest. Therefore, this paper chooses the fourth order lag as the optimal lag order.

Table 2. Selection of optimal lag order of the model

Order of lag AIC BIC HQIC

1 12.1758 13.3204 12.6397

2 12.404 13.7784 12.9622

3 13.2772 14.9603 13.9609

4 10.3116* 12.4358* 11. 1693*

5 11.1296 13.9429 12.2342

5.3. GMM estimation

According to the relevant detection and processing of variables and panel data in the early stage, POV and DFI should be used as variables to construct PVAR model for empirical analysis. POV and DFI represent the Engel coefficient of rural households in each province, and the Digital financial Inclusion development Index of Chinese provinces, respectively, reflecting the poverty level of

rural households in each province and the development level of digital financial inclusion in each region. Table 3 shows the delayed fourth-order regression results of GMM.

Table 3. GMM estimation results

variable h_POV H_DIF

L1.h_POV 0.53** -0.78

L1.h_DFI -0.05 0.56***

L2.h_POV -0.22 -0.34

L2.h_DFI 0.05*** 0. 14***

L3.h_POV 0.12 0.67

L3.h_DFI 0.04*** -0.03

L4.h_POV -0.11 -0.88*

L4.h_DFI -0.04*** -0.08***

Using the systematic GMM estimation method, the PVAR model estimation results between poverty level and regional digital financial inclusion development are obtained. As shown in Table 3, the poverty level with a lag of one period is positively correlated with its current level at the 5% level, and the estimated coefficient is 0.53, indicating that poverty itself has inertia . The development of digital inclusive finance with a lag of two periods and three periods has a significant positive correlation with the poverty level represented by Engel's coefficient, and the absolute value of the coefficient with a lag of three periods is smaller than that of the coefficient with a lag of two periods. It shows that with the development of digital inclusive finance, the living standards of rural people have been improved. The digital financial

inclusion index with a lag of four periods showed a significant negative correlation with the poverty level, further proving that digital financial inclusion can improve poverty.

The digital inclusive amount of the army with the lag of the first and second phases has a significant positive impact on its current development, and its estimated coefficients are 0.56 and 0.14, respectively, indicating that the development of digital inclusive finance has a certain inertia in the early stage. The poverty level of the four lagging periods is

negatively correlated with the digital inclusive financial development index at the level of 10%,

indicating that the lower the poverty level of the region is more conducive to the further development of the digital inclusive financial amount.

5.4. Granger causality test

Then Granger's causality test method is used to study the causal relationship between the poverty level of different provinces and the development of regional inclusive finance. The test results are shown in Table 4. It can be seen that whether the poverty level is the Granger causality test for the development of digital inclusive finance does not reject the null hypothesis, while whether the development of digital inclusive finance is the Granger causality test for the development of poverty level rejects the null hypothesis, indicating

that the development of digital inclusive finance is the Granger cause for the poverty level. But poverty levels are not Granger causes of digital financial inclusion development.

Table 4. Results of Granger causality test

Null hypothesis

χ2 Degree of freedom

p-value

result

DFI is not a Grainger cause of POV

134.58

4

0.000 Turn down

POV is not a Granger cause of DFI 6.3146 4 0.177 Accept

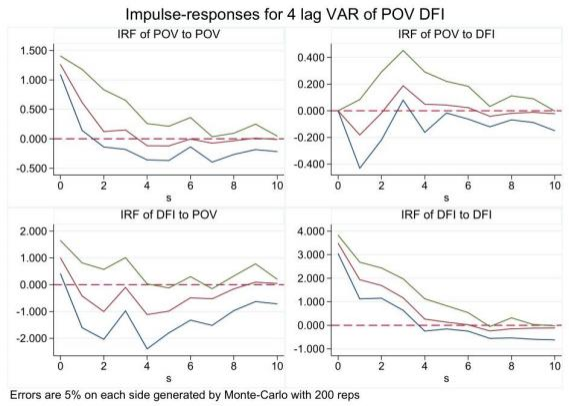

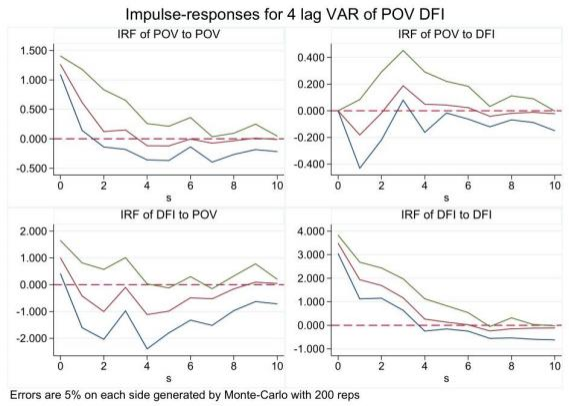

5.5. Impulse response analysis

The impulse response enables a detailed analysis of the interrelationship between poverty levels and

the development of digital financial inclusion. In this paper, 1000 Monte Carlo simulations were conducted, with a time span of 0-10 phases. The result is shown in Figure 1.

From the impulse response analysis in Figure 1, it can be seen that under the impact of one standard deviation of its own, the poverty level will immediately

produce a strong positive response, and then rapidly decline, and by the second stage, its effect is almost insignificant. Poverty levels have little impact on digital inclusion.

When the development level of inclusive finance is hit by one standard deviation, it will have a strong positive response immediately, and then gradually decline until the fourth stage has almost no impact. The impact of the development

of digital financial inclusion immediately produced a positive response to poverty levels, but it soon declined, and by the first stage, the effect had largely disappeared.

According to the Granger causality between variables and the corresponding pulse situation between variables, we can see: First, all provinces need a good foundation to

improve the poverty problem and develop the universal benefit amount; Second, digital financial inclusion has a significant impact on poverty alleviation.

Figure 1 Impulse response

5.6. Variance decomposition analysis

The variance decomposition results can measure the contribution of different disturbance terms to endogenous variable fluctuations, and more accurately examine the degree of interaction between poverty level and the development of digital inclusive finance. In the process of impulse response analysis,

variance decomposition results can be obtained at the same time, and the number of analysis stages is set to 10. The variance decomposition results are shown in Table 5.

Table 5 Prediction variance decomposition

variable Forecast period POV DFI

POV 1 1.000 0.000

2 0.984 0.016

3 0.984 0.016

4 0.967 0.033

5 0.966 0.034

6 0.966 0.034

7 0.965 0.035

8 0.965 0.035

9 0.964 0.036

10 0.964 0.036

DFI 1 0.076 0.924

2 0.069 0.931

3 0.104 0.896

4 0.098 0.902

5 0.146 0.854

6 0.179 0.821

7 0.187 0.813

8 0.196 0.804

9 0.196 0.804

10 0.196 0.804

The impact of poverty levels in the first phase is all in itself. From the second phase, the impact from digital financial inclusion gradually emerged. By the 10th period, the impact on the poverty level is basically stable,

mainly due to its own influence, accounting for 96.4%; This was followed by the impact of the development of digital financial inclusion, accounting for 3.6%.

The development of digital inclusive finance is mainly affected by two aspects: one is its own influence; The second is the impact of poverty levels. The self-influence began to appear from the first phase, but gradually

decreased from 92.4% to 80.4%,and tended to be stable. The effect from the poverty level also began to appear in the first period and increased from 7.6% to 19.6% and stabilized.

Then a natural question is how to use digital financial inclusion to help narrow regional, rural-urban and income disparities and contribute to promoting common prosperity. This paper proposes to further expand digital inclusive financial services to rural areas, support the construction of digital countryside, and focus on making up for the shortcomings of rural inclusive finance, especially giving play to the complementary role between rural physical service points and Internet online services, and promoting the coordinated development of online and offline services. In terms of the financing of small and micro enterprises, it is suggested to give full play to the technical advantages of digital inclusive finance, support the entrepreneurship and innovation of small and micro enterprises, rationally use alternative data to improve the ability of small and micro enterprises to obtain loans for the first loan and credit loan,

and help small and micro enterprises themselves to achieve digital transformation, enabling the long-term sustainable development of small and micro enterprises.

The second is how to further bridge the digital divide to avoid the exclusion of some groups from digital finance, resulting in an increase in the gap between different groups in the enjoyment of financial services in the digital era. It is suggested to continuously strengthen the popularization of digital financial inclusion knowledge and consumer education, focusing on how digital financial inclusion can serve an aging society and support the "silver economy". At the same time, it should continue to play the role of traditional financial services,

strengthen the intelligent, barrier-free, age-appropriate transformation of physical outlets, and make up for the shortcomings and possible failures of digital inclusive finance.

5. Insights from Canada

Canada’s approach to financial inclusion provides valuable lessons for enhancing the effectiveness of digital financial inclusion initiatives in addressing poverty:

5.1 Role of Financial Literacy and Education

Canada emphasizes financial literacy as a key driver of financial inclusion. Programs such as the National Financial Literacy Strategy (2021-2026) aim to equip individuals with the knowledge and skills needed to make informed financial decisions. This is particularly relevant in the context of digital financial inclusion, where a lack of digital literacy can hinder the adoption and effective use of digital financial services.

For China, integrating financial and digital literacy programs into poverty alleviation efforts could amplify the impact of digital financial inclusion.

5.2 Inclusive Access to Digital Infrastructure

Canada has prioritized ensuring access to digital infrastructure, particularly in rural and underserved areas. Initiatives like the Universal Broadband Fund (UBF) aim to provide high-speed internet access to all Canadians, recognizing that digital connectivity is essential for accessing online financial services. Similarly, for digital financial inclusion

to effectively alleviate poverty in China, ensuring equitable access to digital infrastructure across provinces is critical, especially in remote or less-developed regions.

5.3 Targeted Financial Inclusion Policies

Canada has developed targeted programs to address the needs of vulnerable groups, such as low-income households, Indigenous communities, and newcomers. For instance, microloans and community banking services are designed to provide financial access to those excluded from traditional banking systems. In China,

adopting targeted digital financial inclusion policies tailored to the unique needs of different provinces and demographic groups could enhance poverty reduction outcomes.

5.4 Integration of Social and Financial Programs

Canada demonstrates the importance of integrating financial inclusion initiatives with broader social programs. For example, the Canada Child Benefit (CCB) and direct deposit programs ensure that financial assistance reaches those in need efficiently. In the Chinese context, aligning digital financial inclusion

with social welfare programs could strengthen poverty alleviation by ensuring that digital financial services are accessible and effectively used by marginalized populations.

5.5 Data-Driven Monitoring and Evaluation

Canada leverages data and analytics to monitor the progress of financial inclusion initiatives and adapt policies accordingly. For example, the Canadian Financial Capability Survey collects data on financial behaviors and barriers to access. Implementing

a similar data-driven approach in China could help policymakers track the impact of digital financial inclusion on poverty reduction and identify areas for improvement.

6. Conclusion

Based on the data of 31 provinces, cities and autonomous regions in China from 2013 to 2020, this paper establishes a PVAR model to study the relationship between poverty level and the development of digital inclusive payment. The results indicate that digital financial inclusion development is the Granger cause of poverty level, but poverty level is not the Granger cause of digital financial inclusion development. Moreover, all provinces need a good foundation to improve the poverty problem and develop the digital inclusive amount,

and digital inclusive finance can promote the improvement of poverty. Based on the above conclusions, this paper puts forward the following suggestions.

First, promote the improvement of digital financial inclusion services. First, it is necessary to strengthen rural communication infrastructure and network construction, expand the coverage of mobile network terminals, and promote the upgrading of digital inclusive financial services. The development of digital financial inclusion requires strong support of facilities and technologies, so it is necessary to rationally plan and build and develop infrastructure and digital technologies. Secondly, strengthen the training and introduction of relevant personnel. People are the most important factor in the development of digital inclusive finance, and there is a serious problem of talent shortage or even loss in rural areas, so we should pay attention to the role of talents, and increase the introduction of

digital inclusive finance infrastructure construction and related technical personnel. Finally, it is necessary to actively play the advantages of digital inclusive

finance, strive to provide diversified and personalized products and services, and continue to innovate to increase the availability of formal loans for rural families,

so that rural families can enjoy perfect financial services.

Second, we will accelerate the improvement of the regulatory system for digital financial inclusion. On the one hand, it is necessary to accelerate the construction of an effective and inclusive digital financial regulatory system. The government should speed up the implementation of laws and regulations regulating the operation of digital inclusive financing to promote its healthy development. At the same time, we should improve the level and intensity of supervision and clarify the responsibilities of supervision departments. On the other hand, we need to ensure the security and reliability of digital information technology. In this regard, it is not only necessary to strengthen the technical requirements of digital information development, but also to strengthen information disclosure, severely crackdown on the use of financial fraud, and protect the legitimate rights and interests of rural residents. At the same time, a financial risk supervision system covering all rural areas will be established to completely eradicate the proliferation of illegal financial activities in rural areas. The government attaches great importance to and increases the construction of the rural financial risk system, extends the financial risk prevention or prediction organization to townships and rural village groups, in addition to the relevant functional departments of the government to seriously perform the supervision function, establish a social three- dimensional supervision system, hire farmers as financial risk early warning officers, set up a report telephone, implement a report reward system, and mobilize the enthusiasm and initiative of farmers to participate in financial risk supervision. Form a joint regulatory force, improve the sensitivity of financial risk prevention and the ability to strike quickly, avoid the phenomenon of "hindsight", nip illegal fundraising, financial fraud and other activities in the bud, and completely purify the rural financial environment. Thirdly, a financial investment system covering all rural areas should be established to completely get rid of the narrow investment channels of farmers. The government and agriculture-related financial departments should combine the opportunity of rural "three rights" reform to develop farmers' property financial investment products, including the purchase of large negotiable certificates of deposit, capital guaranteed income financial products, etc. And provide farmers with whole-process financial services, act as a good investment consultant, attract all the "three rights" property income into the financial system, establish a whole-process transparent, controllable risk, and high investment return financial investment system, prevent farmers from "three rights" income and other income to participate in social illegal financial activities, so that farmers can truly expand investment and financial channels.

We will increase income from financial assets, share the fruits of economic and social development, and completely rid ourselves of illegal financial activities.

Third, vigorously improve the financial literacy of farmers. Up to now, there are still some people who have little understanding of digital financial products and services, and lack the ability to use information technology for financial activities, especially the financial literacy of rural residents and the elderly. Obviously, in the forthcoming promotion of rural financial system innovation, we should cultivate farmers' financial consciousness and improve farmers' financial knowledge. In the practice of financial reform over the past 20 years, although many experts and scholars have put forward such suggestions, they have not been well implemented so far, and the problem is that governments at all levels and functional departments have not paid enough attention to them. To this end, we can no longer forget this extremely important content, and should make up this lesson to farmer friends in time. Cultivating farmers' financial consciousness is a systematic social project, which is not an easy task. Relevant departments should pay more attention to the publicity work of digital finance,

and carry out targeted publicity of digital financial knowledge to farmers in underdeveloped areas to improve their financial literacy.

Fourth, drawing from Canada’s experience, the following recommendations can be made to enhance the impact of digital financial inclusion on poverty alleviation in China: Promote Digital and Financial Literacy: Implement nationwide education programs to ensure that individuals can effectively use digital financial services; Enhance Digital Infrastructure: Invest in digital connectivity in underserved regions to reduce disparities in access to digital financial services;Develop Targeted Policies: Tailor digital financial inclusion initiatives to the specific needs of different provinces and populations;Integrate with Social Programs: Align digital financial services with poverty alleviation and social welfare

initiatives for greater impact;Adopt Data-Driven Approaches: Regularly monitor and evaluate digital financial inclusion programs to refine strategies and maximize outcomes.

From the current point of view, we should implement and consolidate the cultivation project of farmers' financial awareness from three aspects: First, establish a financial risk education and cultivation system covering all rural areas to change the fragile situation of farmers' financial risk awareness. The cultivation of farmers' financial awareness will be included in the important performance assessment content of county (township) governments and agriculture- related financial institutions, and comprehensive rotation training will be conducted for township cadres, village branch committees,

village group cadres and all farmers through government-funded and financial institutions to organize various training courses and farmer night schools.

Teach the forms and characteristics of illegal financial activities such as illegal fund-raising, underground Mark Six lottery, financial fraud, and improve farmers' awareness of integrity, etc., and regularly or irregularly pass examinations to improve farmers' ability to identify illegal fund-raising and financial fraud. At the same time, establish a long-term cultivation mechanism for farmers' financial awareness, incorporate financial risk prevention, safe investment and financial management knowledge and integrity education into the education curriculum of rural primary and secondary schools, and through the efforts of one or two generations, completely change the backward face of farmers' credit

awareness and financial risk awareness, improve farmers' credit concept, enhance their awareness of preventing financial risks, and improve their financial investment ability.

From the perspective of rural financial system innovation, it is necessary to increase and improve the service institutions of rural financial institutions, innovate the service model and improve the service level, and promote the development of inclusive finance. Expand the service capacity of existing financial institutions, realize the shift of service focus to rural areas, and use funds for local "agriculture, rural areas and farmers"; We will establish a government-funded county-level financing guarantee institution, improve the compensation mechanism for rural credit losses, promote the establishment of a market-based risk compensation mechanism at the local level, prudently carry out mutual fund assistance within rural cooperatives, promote the construction of a rural credit system, and expand the coverage of agricultural insurance. Undoubtedly, if these rural financial system innovations are put into practice,

they will certainly promote the improvement of rural financial service environment and greatly improve the availability of "three rural" financial services.

1.

Appiah-Otoo, I., Chen, X., Song, N., & Dumor, K. (2022).

Financial development, institutional improvement, poverty reduction: the multiple challenges in West Africa. Journal ofPolicy Modeling, 44(6), 1296-1312.

2.

Boukhatem, J. (2016). Assessing the direct effect of financial

development on poverty reduction in a panel of low-and middle-income countries. Research in International Business and Finance, 37, 214-230.

3.

Fazio, A., & Reggiani, T. (2023). Minimum wage and tolerance for high incomes. European Economic Review, 155, 104445.

4.

Guo, F., Kong, T., Wang, J., Zhang, X., Cheng, Z., Ruan, F., Sun, T., & Wang, F. (2016). China's digital inclusive finance indicator system and index compilation (Working paper).

Digital Finance Research Center, Peking University.

5.

Hellmann, T., Murdock, K., & Stiglitz, J. (1997). Financial restraint: toward a new paradigm.

The role of government in East Asian economic development: Comparative institutional analysis, 163-207.

6.

Jiao, J., Huang, T., Wang, T., Zhang, S., & Wang, Z. (2015). The development process and empirical research of inclusive finance in China. Shanghai Finance, 2015(4), 12-22.

7.

Law, S. H., Khair-Afham, M. S., & Trinugroho, I. (2024). Financial inclusion and income inequality in develop countries: The role of aging populations.

Research in International Business and Finance, 67, 102110.

8.

Li, H., Squire, L., & Zou, H. F. (1998). Explaining international and intertemporal variations in income inequality. The Economic Journal, 108(446), 1998, 108-43.

9.

Liu, F., & Walheer, B. (2022). Financial inclusion, financial technology, and economic development: A composite index approach.

Empirical Economics, 63(3), 1457-1487.

10.

McKinnon, R. and Shaw, E. (1973) Financial Deepening in Economic Development. Brookings Institution, Washington DC.

11.

Pradhan, R. P., Arvin, M. B., Nair, M. S., Hall, J. H., & Bennett, S. E. (2021).

Sustainable economic development in India: The dynamics between financial inclusion, ICT development, and economic growth. Technological Forecasting and Social Change, 169, 120758.

12.

Shen, H., Luo, T., Gao, Z., Zhang, X., Zhang, W., & Chuang, Y. C. (2023). Digital financial inclusion and the urban–rural income gap in China:

empirical research based on the Theil index. Economic Research-Ekonomska Istraživanja, 36(3), 2156575.

13.

Su, J., & Liao, J. (2009). Empirical analysis of the relationship between financial development, income distribution,

and poverty in China: A study based on dynamic panel data. Science of Finance and Economics, 2009(12), 10-16.

14.

Sun, S., & Tu, Y. (2023). Impact of financial inclusion on the urban-rural income gap—Based

on the spatial panel data model. Finance Research Letters, 53, 103659. https://doi.org/10.1016/j.frl.2023.103659

15.

Wang, J. (2023). Digital inclusive finance and rural revitalization. Finance Research Letters, 57, 104157.

16.

Wang, X., Wang, Y., & Zhao, Y. (2022). Financial permeation and rural poverty reduction Nexus:

Further insights from counties in China. China Economic Review, 76, 101863.

17.

Xiong, M., Fan, J., Li, W., & Sheng, B. T. (2022). Can China’s digital inclusive finance help rural revitalization? A perspective based on rural

economic development and income disparity. Frontiers in Environmental Science, 10, 2095. https://doi.org/10.3389/fenvs.2022.1011159

18.

Zhang, R., & Naceur, S. B. (2019). Financial development, inequality, and poverty: Some international evidence. International Review ofEconomics & Finance, 61, 1-16.

19.

Zhang, W., Chen, F., Liu, E., Zhang, Y., & Li, F. (2023). How does digital inclusive finance promote the financial

performance of Chinese cultural enterprises?. Pacific-Basin Finance Journal, 82, 102146.

20.

Zhao, H., Zheng, X., & Yang, L. (2022). Does digital inclusive finance narrow the urban-rural income gap through primary distribution and

redistribution?. Sustainability, 14(4), 2120.

21.

Zhu, X., Chen, X., Cai, J., Balezentis, A., Hu, R., & Streimikiene, D. (2021). Rural financial development, spatial spillover, and poverty reduction:

evidence from China. Economic research-Ekonomska istraživanja, 34(1), 3421-3439.

Figure 1 Impulse response

Figure 1 Impulse response